Blockwall - August 2024 - What happened in Web3?

Dear Founders, Investors, and Friends,

In terms of market performance, August was a tough month. However, a closer look reveals several promising fundamental developments within the crypto space, painting a quite different picture. With that said, let’s start by examining the key factors that impacted the markets this month.

Market Update

A perfect storm unfolded at the start of the month, triggering the largest market crash since the FTX collapse in November 2022. Over the course of a few hours, BTC shed nearly 15%, dropping to $49,500, while ETH (-19%) and SOL (-21%) suffered even sharper declines.

The sell-off extended beyond the crypto markets, as the S&P 500 also posted its worst performance since September 2022.

So, what triggered this widespread downturn?

Unwinding of the Yen Carry Trade

The primary driver behind the turmoil was likely the widespread unwinding of the popular yen carry trade, a strategy that had long thrived on Japan’s near-zero interest rates. Investors capitalized on low-cost yen borrowing, reallocating the funds into more lucrative, higher-yielding assets across global markets.

In the early hours of Monday, August 5th, the trade quickly unraveled as the yen soared by 11% against the U.S. dollar, driven by the Bank of Japan's recent rate hike and weaker U.S. labor market figures. The result was a rapid liquidation of assets, prompting a significant market sell-off as investors scrambled to cover their short yen positions.

Given the markets’ swift recovery following the crash, it’s clear this wasn't a sell-off driven by underlying fundamentals. Instead, it was a short-lived yet sharp deleveraging event, during which market risk was effectively mitigated.

Recession Concerns

Despite the initial panic, discussions surrounding a potential U.S. recession dominated the narrative in the days that followed.

Weak labor market data, particularly in the manufacturing sector, were the main drivers, with the Fed facing criticism for waiting too long to implement rate cuts. Some even called for emergency rate cuts.

However, that sense of urgency has since eased.

Following the market crash, the odds of an emergency rate cut on Polymarket surged to 38%

Rate Cuts

The eyes also were on the Fed’s FOMC meeting on September 17/18, where it determined the size of the first rate cut in over four years.

Before the 18th September, both CME FedWatch and Polymarket projected a 0.25 bps cut.

In the end, the Fed decided to cut the rate by a half point at the September meeting.

Institutional and Corporate Adoption

Now, let’s move beyond the market turbulence and focus on the fundamental developments we mentioned earlier.

The first update comes from Grayscale.

Throughout August, the firm has introduced four new crypto trusts:

Bittensor ($TAO)

Sui ($SUI)

Maker ($MKR)

Avalanche ($AVAX)

These trusts provide accredited investors with new opportunities to access these assets, bringing Grayscale’s total portfolio of trust offerings to 21.

Beyond Grayscale’s new offerings, institutional investors made headlines this month, shedding light on their crypto allocations.

13F filings

At the start of August, the latest 13F filings were released, offering valuable insights into the portfolios of U.S. institutional investors.

Just as a reminder: Each quarter, U.S. institutional investment managers with $100 million or more in assets under management (AUM) are required to disclose their holdings through a 13F filing.

Now, let's take a brief look at what the filings revealed about institutional Bitcoin ETF holdings:

Based on data from K33 Research 1,199 professional investment firms held shares in Bitcoin spot ETFs as of June 30, marking an QoQ increase of 262 firms (roughly 21%).

Institutional share of total spot ETF AUM rose by 2.4%, now accounting for 21.2%. Investments by retail investors therefore still dominate.

According to Matt Hougan from Bitwise, 44% of all Q1 filers increased their positions, 22% held steady, 21% decreased their holdings, and 13% exited completely.

Whereas GBTC saw further outflows of institutional capital, IBIT (BlackRock) and FBTC (Fidelity) attracted professional investors. A major seller of Grayscale's GBTC was Morgan Stanley, which sold all of its shares, thereby trimming its ETF holdings from $270 million to around $189 million.

New York-based investment firm Millennium, managing over $68 billion in assets, has also cut its Bitcoin ETF holdings from about $1.9 billion in Q1 to $1.15 billion.

The Wisconsin Pension fund, on the other hand, doubled down on Bitcoin: As of the end of June, it owned $98.9 million in spot Bitcoin ETFs. In addition to that, Goldman Sachs made its debut in the crypto ETF market, investing around $418 million.

As of now, institutional ETF holders still largely consist of hedge funds. Going forward, I really hope we will see more investments by wealth managers - as well as pension funds following Wisconsin's lead.

Additionally, it will be interesting to see how much institutional capital will be allocated in the Ether ETFs by the time the next 13F filings are released.

PYUSD reaches milestone

Since expanding to the Solana network in May, the total supply of PayPal's PYUSD Stablecoin has surged by approximately 360%, surpassing 1 billion before settling at around 860 million.

In addition to that, its supply on Solana has surpassed its supply on Ethereum, despite the token being launched there in August of last year.

With a market capitalization of around 500 million it is the third biggest stablecoin on Solana, right behind USDT ($712 million) and USDC ($2.6 billion).

Its rapid growth was primarily fueled by PYUSD's integration into Solana's leading lending protocol, Kamino Finance.

Since early July, PayPal has been subsidizing an incentive program, paying Kamino users up to 20% on their deposited PYUSD.

PayPal recognizes that in the stablecoin market, liquidity begets liquidity, and that ensuring ample liquidity is crucial for positioning its own stablecoin as a competitor to established giants like USDT and USDC.

Institutional Lending

At the end of the month, the Berlin-based startup Centrifuge announced the launch of the first lending market for tokenized U.S. Treasuries on Base, integrating Coinbase’s verification service to ensure compliance. This allows institutional investors to engage with verified counterparties, meeting critical regulatory standards.

Centrifuge has chosen the Morpho lending platform for this initiative, utilizing isolated markets to maintain strict risk parameters and liquidity control. By pooling liquidity from various tokenized T-bill products, Centrifuge enhances efficiency and scale for institutional lenders.

This marks a significant step for institutional DeFi adoption, enabling investors to keep capital onchain while accessing immediate liquidity without the need of liquidating their tokenized T-bills. It also represents a pivotal move toward building the infrastructure needed to attract more institutional players into the DeFi ecosystem.

Sony launches its own layer 2 network

One year after its initial announcement, Sony has officially launched its blockchain network, Soneium, marking a significant step in the company’s exploration of blockchain technology. Soneium operates as an Ethereum layer 2 and utilizes the technology of Optimism, one of Ethereum’s leading layer 2s. The network is being developed in collaboration with Startale Labs, the team behind the Astar Network.

Currently, Soneium is live on a testnet, accessible to both developers and users. The network is primarily intended to serve as a platform for solutions and applications in the creative and gaming industries. As part of its launch, Sony introduced an incubation program offering protocols the opportunity to secure financial and strategic support, further strengthening the ecosystem. Financial support for this initiative is also being provided by Samsung, which recently invested in Startale Labs.

The rollout of Soneium will occur in several stages. Initially, the network will focus on onboarding Web3 developers and users. Following this, Sony plans to integrate products and intellectual property from its vast conglomerate, including content from Sony Music and Sony Pictures, into the ecosystem. In the final phase, external companies will be encouraged to build on the platform, expanding its reach.

As one of the world’s largest corporations, Sony has been exploring blockchain technology since 2017 for various applications. If Soneium proves successful, it could inspire other companies to pursue their own blockchain initiatives, further driving innovation in the space.

OpenSea vs. SEC

But there was still a setback at the end of the month. On August 28, 2024, OpenSea, the world’s largest NFT marketplace, received a Wells notice from the U.S. Securities and Exchange Commission (SEC). The notice alleges that certain NFTs on the platform may qualify as securities, signaling the SEC’s intent to take legal action against OpenSea. The marketplace, which facilitates the buying, selling, and creation of NFTs, now faces the prospect of a lawsuit, joining other crypto firms like Coinbase and Uniswap in the regulatory spotlight.

This action by the SEC is part of its broader crackdown on the crypto space, but targeting NFTs is new ground. Devin Finzer, OpenSea's CEO, expressed shock and disappointment, stating that this move threatens the livelihoods of creators and artists who rely on NFTs for income. OpenSea has vowed to fight back, framing this as a critical moment for the future of digital art and innovation.

The Wells notice to OpenSea reflects the SEC’s increasing scrutiny of NFTs, similar to its ongoing investigation of Yuga Labs, the creators of Bored Ape Yacht Club. If the SEC succeeds in classifying NFTs as securities, the consequences could be wide-ranging. This would not only affect NFT creators but also the platforms and investors involved, potentially introducing burdensome compliance costs and stifling creativity.

Looking ahead, this case could set a major precedent for the NFT space. Regulating NFTs as securities could open a legal Pandora’s box, affecting not only the crypto world but also the broader art markets. After all, the SEC has never classified physical art as securities, so it's unclear why digital art should be treated differently. How this unfolds could determine the future direction of NFT regulation, possibly leading to clearer frameworks or, alternatively, more restrictive measures.

We will continue to keep a close watch on how this situation develops.

Portfolio Company Update

We were able to close one more investment in August which we will announce soon. Aswell, one of our portfolio companies achieved a major milestone.

Spiko, a French tokenization startup, surpassed $100 million in subscription and redemption volumes for its tokenized T-bill products.

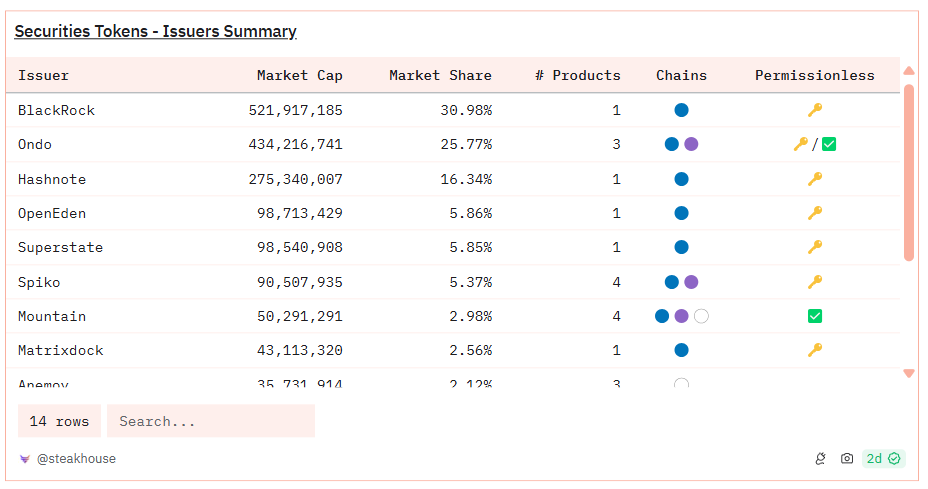

Three months after the protocol's launch, investors have allocated $40 million and €52 million into Spiko's tokenized U.S. and European T-bills, respectively, pushing the company’s market share in the tokenized treasuries sector to over 5%.

Key events of the last few weeks

Bitwise announces the acquisition of ETC Group

With this move, the American crypto asset manager increases its total assets under management to nearly $4.5 billion and expands its product offering to include nine European crypto ETPs. ETC Group is a London-based financial services firm known for offering exchange-traded products (ETPs), including Bitcoin, Ethereum, and other digital asset-backed securities. (Source: Bitwise)

MetaMask introduces a crypto debit card

Selected users across the EU and UK can now spend their crypto holdings via a Mastercard. (Source: MetaMask)

The SEC rejects 19b-4 applications for a Solana spot ETF.

The reason cited is the classification of SOL as a security. While the S-1 filings from VanEck and 21Shares are still pending, the approval process has effectively been halted due to the rejection. (Source: TheBlock)

Wyoming announces the development of its own U.S. stablecoin

The 'Wyoming Stable Token' is expected to go live in the first quarter of next year. In addition to offering more affordable transactions for its residents, the U.S. state aims to create a new revenue stream through this initiative. (Source: CNBC)

Bloomberg Terminal integrates Polymarket data on the U.S. election

The Bloomberg Terminal is an essential tool for financial professionals, offering real-time access to market data, news, and analytics. Besides Bloomberg, journalists from leading outlets such as The Wall Street Journal and CNN are also increasingly turning to the blockchain-based prediction markets for their data insights. (Source: Bloomberg)

New details emerge on Trump’s DeFi project

The DeFi project World Liberty Financial (WLF), with ties to Trump's sons, announced that it is working with the lending protocol Aave to develop a platform aimed at "advancing the mass adoption of stablecoins and decentralized finance". According to a report from CoinDesk, WLF is set to be a decentralized lending platform. (Source: CoinDesk)

What we’ve been reading

Gartner: Blockchain & Web3 Hype Cycle 2024

In their latest Hype Cycle, the global research and advisory firm Gartner illustrates and assesses the typical stages of development and adoption for different technologies adjacent to Blockchain & web3. On LinkedIn, Dominic shared his perspectives, highlighting both areas of agreement and points of contention with Gartner's analysis.a16z: Guide to Token Compensation

In this guide a16z crypto provides advice on how web3 companies can develop token compensation strategies that fit their needs. In addition, they present best practices for designing a token’s vesting schedule - one of the most critical aspects of creating a token - along with the pros and cons of different approaches. See Dominic's post on LinkedIn for more insights.

Disclaimer

To avoid any misinterpretation, nothing in this blog should be considered as an offer to sell or a solicitation of interest to purchase any securities advised by Blockwall, its affiliates or its representatives. Under no circumstances should anything herein be interpreted as fund marketing materials for prospective investors considering an investment in any Blockwall fund. None of the data and information constitutes general or personalized investment advice and only represents the personal opinion of the author. The author and/or Blockwall may directly or indirectly be exposed to the mentioned assets/investments. For further information please view the full Disclaimer by clicking the button below.

This work is licensed under the Creative Commons Attribution – No Derivatives 4.0 International License. CC BY-ND 4.0 Legal Code | Creative Commons