Blockwall - September 2024 - What happened in Web3?

Dear Founders, Investors, and Friends,

After a rather calm summer the month of September turned out to be quite eventful. Besides continued institutional adoption and regulatory developments, we saw a wave of announcements from major crypto conferences happening in Asia. The most impactful event, however, was the start of the Federal Reserve’s easing cycle. So, without further ado, let’s take a look at the most important developments in September.

The Beginning of the Easing Cycle

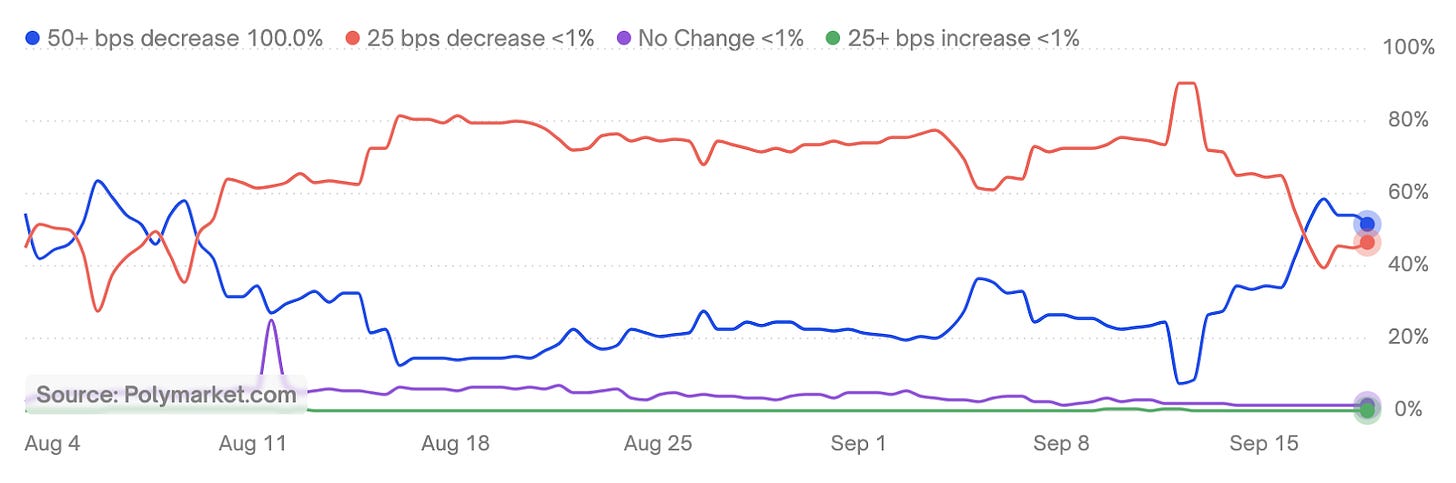

For the first time since March 2020, the Fed has cut interest rates. While the markets have been confident in previous weeks that we will witness a 25 bps reduction, sentiment shifted just days before the FOMC meeting, with expectations tilting towards a 50 bps cut.

In the end, the Fed's final decision to cut rates by 50 bps confirmed the revised expectations, surprising many experts. The markets responded positively, with the S&P 500 climbing 2.6%, NASDAQ gaining 4%, and the total crypto market cap surging by 15%. The rally gained further traction after China announced a nearly $280 billion economic stimulus package.

This rate cut signals the start of the easing cycle, with global liquidity - and therefore the prices of risk assets - set to rise. Other central banks, previously cautious about diverging from U.S. policy due to currency concerns, may now also follow suit.

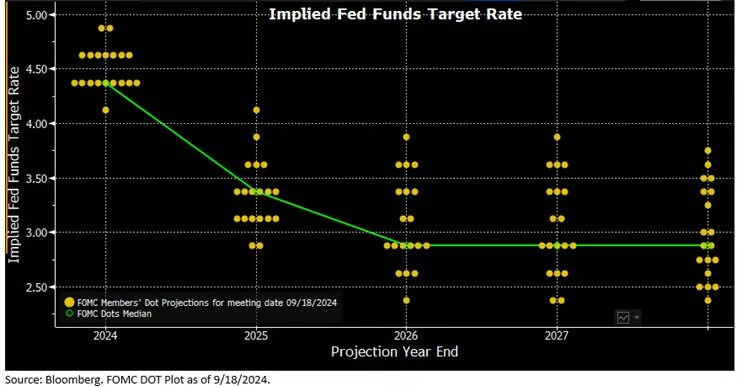

The Fed’s updated forecasts, including the latest dot plot, suggest the federal funds rate could reach 4.4% by year-end, pointing to another 50 bps cut - though opinions within the committee remain divided (see the yellow dots).

As we look ahead to the November and December policy meetings, labor market data will be key to guiding further decisions.

Tokenization

Tether’s Tokenization Plans Revealed?

In September, Tether, the prominent stablecoin issuer, made headlines with the acquisition of $102 million worth of shares in Adecoagro SA, a leading South American agricultural company. With a 9.8% ownership stake, Tether has now positioned itself as the third-largest shareholder of the Argentine firm. While Tether officially describes the investment as a strategic complement to its existing holdings in Bitcoin and gold, there is growing speculation that this move may also be tied to its ambitions in the tokenization space.

Earlier reports from May revealed that Adecoagro holds investments in two tokenization ventures, which are advancing the company’s own digital initiatives. One of these ventures, Landtoken, a startup closely linked to Adecoagro, successfully completed the tokenization of its first agricultural field in January, offering investment opportunities starting from just $100.

The second venture is Agrotoken, an Argentine startup that recently attracted investment from Visa. Agrotoken specializes in the tokenization of agricultural commodities such as soy, corn, and wheat. Adecoagro has already tokenized approximately 7,000 tons of its harvest through this platform, converting them into digital assets.

Agrotoken’s platform aims to provide farmers with faster liquidity, enabling them to trade their commodities around the clock. In addition, partnerships with major financial players like Visa and Santander Bank allow the tokens to be used as a means of payment or as collateral for loans.

Given these developments, Tether’s investment in Adecoagro seems to be more than just a play for agricultural commodity exposure. It likely signals the groundwork for a deeper strategic collaboration, potentially leveraging tokenization technologies.

Visa Introduces Own Tokenization Platform

With the Visa Tokenized Asset Platform (VTAP), the global payment network announced its own solution that enables financial institutions to issue and manage fiat-backed tokens on blockchain networks.

The first official partner is Spain's BBVA, the country’s second-largest bank. Together, the two companies will explore in the coming months how the bank's Euro-token should be backed - whether through deposits, money market funds, or fully with cash reserves. Various tests will be conducted in a sandbox environment before the token is launched on the Ethereum mainnet next year.

Visa's platform initially targets financial institutions that aim to provide more efficient cross-border payments for their multinational clients. First, these transfers will be limited to a bank's customer base, with cross-chain communication between different banks and networks enabled later on.

Additionally, the platform is designed to empower banks through the use of smart contracts to automate existing processes and develop new use cases - such as instant settlement when purchasing tokenized assets or automating complex credit lines where payments are automatically released when predefined conditions are met.

Banks can decide individually what forms of digital money they want to issue - be it deposit tokens, e-money tokens, or tokenized shares of a money market fund.

From the announcement, several important takeaways can be drawn.

First, Visa has recognized that it must disrupt itself to some extent to avoid being disrupted by others. On that path, it can leverage its existing network effects and regulatory credentials. In the future, their value will lie primarily in facilitating seamless communication between different blockchain networks, banking and payment systems, and token standards - especially as transaction fees decrease.

Second, the market structure for digital money is more open than ever. Despite its growing adoption, liquidity in stablecoins is still not large enough to bring the global financial system on-chain. More than 90% of the world’s money supply is controlled by commercial banks. Whether these banks will issue their own stablecoins or opt for deposit tokens remains to be seen.

Third, despite competition from more performant networks like Solana, Ethereum remains the preferred network for large enterprises.

Further Institutional Adoption of Tokenization

In addition to Tether and Visa, several other financial institutions unveiled tokenization initiatives last month.

Janus Henderson has entered the tokenization space, as reported by the Financial Times. The British investment firm, which manages nearly $360 billion in assets, will soon oversee a tokenized fund developed by the tokenization platform Anemoy.

In parallel, WisdomTree unveiled its new institutional-focused tokenization platform, WisdomTree Connect. The platform aims to offer institutional investors and businesses a secure and streamlined way to bridge the gap between traditional finance and decentralized finance (DeFi).

Meanwhile, digital asset manager Kin launched a $100 million Real-World Asset (RWA) fund, which allows accredited investors to invest in tokenized real estate trust deeds. The fund is hosted on the Chintai network, a blockchain specializing in RWAs, holding a regulatory license from Singapore’s central bank.

Stablecoin Market Update

BitGo Enters the Stablecoin Market

Alongside early reports about Revolut's advanced stablecoin plans - though details remain scarce - BitGo, the U.S.-based custody provider, has announced the upcoming launch of its own U.S. stablecoin, slated for release in January next year.

Much like Agora, Nick Van Eck’s stablecoin project, BitGo aims to distribute the majority of the revenues generated by its USDS stablecoin to key stakeholders such as market makers, exchanges, and financial institutions. An impressive 98% of the earnings will be shared with these partners, leaving BitGo with just a 2% share after management fees.

BitGo’s CEO, Mike Belshe, clarified that end users will not be included in this revenue-sharing model, as doing so could potentially violate securities regulations and draw unwanted attention from the SEC.

Whether this approach will be enough to challenge the dominant network effects of Tether and Circle remains uncertain, though it appears unlikely.

One indication of this is PayPal’s stablecoin PYUSD, which, despite an extensive incentive program, saw its circulating supply reach $1 billion by the end of August, only to lose roughly $250 million soon after.

Additionally, the potential decline in yields on U.S. Treasury bonds may dampen the appeal for institutional partners to collaborate with new stablecoin entrants.

Nevertheless, the continued upward trajectory of global stablecoin growth is undeniable, and it will undoubtedly attract a wave of new competitors into the market.

Ethena Announces New Stablecoin

A few days later, Ethena Labs followed up with the announcement of its new stablecoin.

While USDe, the protocol’s current stablecoin, maintains its dollar peg through a delta-neutral trading strategy leveraging on-chain derivatives, UStb takes a more conservative approach. Its reserves will be fully invested in BUIDL, BlackRock’s tokenized money market fund.

Ethena’s plan, as outlined in the announcement, is to launch UStb as both a standalone stablecoin and as a safety net for USDe. In periods when funding rates turn negative, forcing short traders like Ethena (as part of the hedging mechanism for USDe) to pay long traders, Ethena will reduce its short positions and shift reserves into UStb.

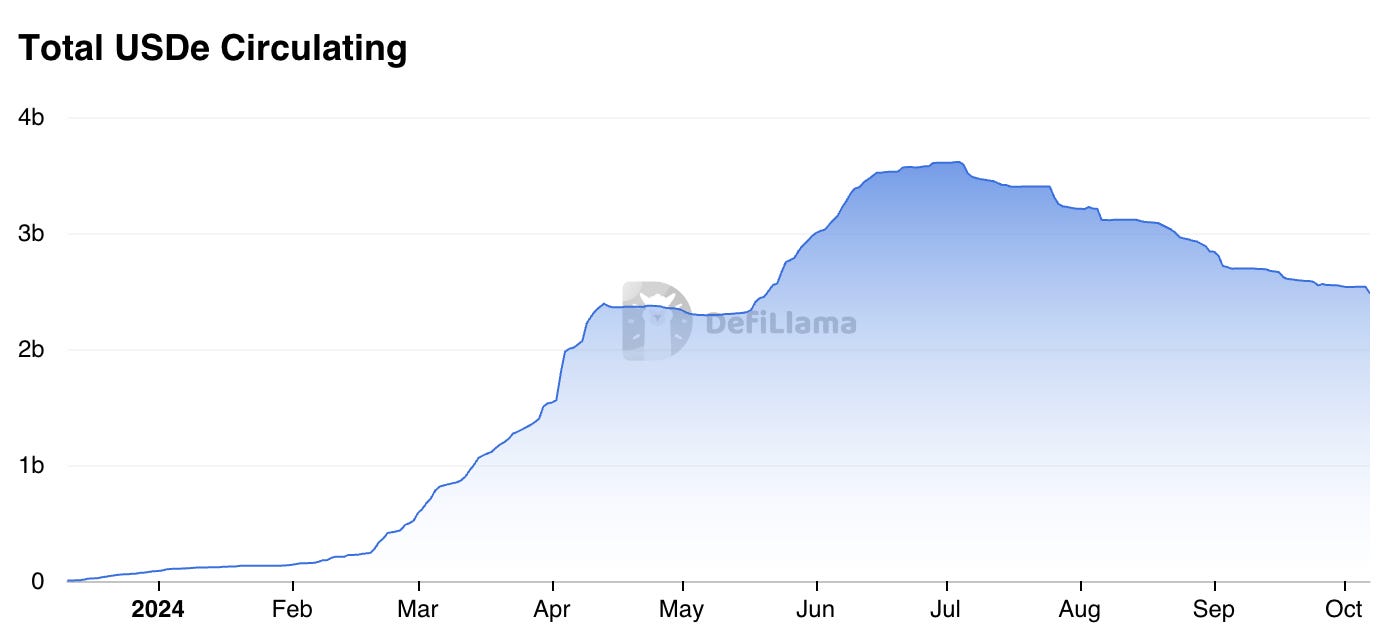

This strategy is designed to reassure the market about USDe’s stability, especially since funding rates have become a perceived weakness of the project. Although funding rates have rarely stayed negative for more than a week, falling and occasionally negative returns have led to investor flight from USDe, resulting in a loss of over one billion dollars in market capitalization.

Source: DefiLlama

If the Ethena community gives the green light to the UStb proposal in the coming weeks, Ethena would become the fourth protocol, after Ondo, Mountain Protocol, and Midas, to back a stablecoin with BUIDL.

Ethena sets itself apart from most stablecoin projects by not directly competing with Tether and Circle. Instead, they are focusing on establishing themselves as the go-to collateral asset on major trading platforms.

Partnerships with Bitget and Bybit have already been announced, with another major CEX partnership to be revealed soon. Users on these platforms will be able to use USDe, and soon UStb, as margin collateral, earning returns while doing so - something USDC and USDT cannot offer. This presents a market with billion-dollar potential, especially if funding rates surge again in a potential bull market.

Regulatory Updates

This month brought important updates concerning the controversial accounting rule SAB 121. As a reminder, the SEC Accounting Bulletin 121 requires digital asset custodians to account for digital assets as liabilities and hold them at fair value on their balance sheets. This means that if a bank, for example, custodians $1 billion worth of Bitcoin for their customers, they must also hold $1 billion in cash to offset this 'liability' on their balance sheet, resulting in high capital requirements that have made crypto custody unattractive for U.S. banks.

However, in a recent speech, SEC Chief Accountant Paul Munter acknowledged that exceptions to SAB 121 are possible under certain conditions, and some have already been granted - a shift that could finally pave the way for U.S. banks to enter the crypto market.

According to Munter, banks and broker-dealers could qualify for an SEC exemption if they meet certain criteria:

Banks must obtain explicit approval from their respective regulatory authorities and ensure that crypto assets held in custody remain protected in the event of bankruptcy.

Broker-dealers must demonstrate that they do not have access to their clients' private keys and that clients maintain in legal control over their assets at all times.

Despite these potential exemptions, Munter stressed that the core principles of SAB 121 remain intact, with exceptions applicable only in well-defined, specific cases.

Nevertheless, if this regulatory opening persists, large financial institutions could soon offer their own crypto custody services. This is significant, as many institutional investors prefer to store their digital assets with trusted banking partners.

What’s even more significant is that banks are not just custodians - they are also lending institutions. Custody services provide the foundation for broader offerings, particularly lending with Bitcoin as collateral. This is a use case that could make BTC far more appealing and valuable to institutional investors.

Shortly after this announcement, it was revealed that BNY Mellon, the world's largest custodian with $49 trillion in assets under custody, had become one of the first institutions to receive such an exemption, which also allows BNY Mellon to serve as a custodian for Bitcoin and Ether spot ETFs. This news, in particular, might further boost the confidence of many institutions and institutional investors in the crypto industry and digital assets as an emerging asset class.

SEC Approves BTC ETF Options

Several months after filing the initial application, Nasdaq received approval from the SEC to list and trade options on BlackRock's spot Bitcoin ETF (IBIT) - a move poised to significantly reshape market dynamics.

With this approval, investors now have their first opportunity to directly speculate on Bitcoin's spot market volatility or hedge against it. This is a true game-changer, especially for institutional investors, who will be able to deploy more sophisticated strategies. Since the options are American-style, they can be exercised at any time before expiration, offering greater flexibility and, in many cases, a more cost-effective alternative to existing CME futures.

One of the most important outcomes of this approval is its potential to substantially enhance Bitcoin’s market liquidity. Market makers now have more versatile hedging options and can also generate additional yield by selling call options on their Bitcoin holdings. This could make the market more appealing to them, resulting in greater liquidity and attracting larger institutional players - a virtuous cycle that may contribute to a more stable and efficient market. Increased liquidity typically leads to tighter spreads and better price discovery, which could, in turn, draw even more investors.

However, these new options could also introduce higher volatility, especially as large positions accumulate and move into the money. For instance, if billions of dollars in call options are betting that IBIT's price will surpass a certain level and the price begins to rise, option sellers may need to quickly purchase Bitcoin in the market to cover their obligations - further driving the price up. Such a gamma squeeze was previously seen during the GameStop surge. Unlike stocks, however, new Bitcoin cannot simply be issued, which could result in even sharper price spikes.

Looking ahead, these Bitcoin options could pave the way for a variety of new financial products, such as structured bonds with variable yields, accelerating the financialization of the crypto market. While the exact date for trading to commence is still pending, final approval from the CFTC and the Options Clearing Corp is required.

Recap: Solana Breakpoint

September was an especially busy month for us at Blockwall, as part of our team traveled to Singapore for the various crypto conferences and events taking place there, with the main ones being Token2049 and Solana's Breakpoint.

As early investors in Solana, we were particularly keen on the latter event. These are, in our view, the most important highlights:

Solana ‘Seeker’

Solana Mobile has announced details about its second phone, the 'Seeker', slated for release in 2025. The device will include an integrated wallet and a secure seed vault for enhanced crypto management.

With over 140,000 pre-orders so far, the $450 Seeker has generated $63 million in revenue for Solana Mobile. This price point is notably lower than the $1,000 launch price of Solana’s first phone, the Solana Saga.

One major similarity, though, is the marketing strategy for both devices: each Seeker phone comes with a Genesis NFT, potentially positioning owners for future token airdrops.

Firedancer Update

Solana’s biggest network upgrade is drawing near. Nearly two years after its initial announcement, the Firedancer client has now launched on Solana’s testnet, with a beta version already live on the mainnet (though it’s not yet participating in block production).

The Firedancer client represents a major milestone for Solana for two key reasons. In terms of performance, Firedancer can process roughly one million transactions per second, making it over 20 times faster than Solana’s current client implementation. For perspective, the Visa network handles up to 65,000 transactions per second.

Equally important is the impact on decentralization. Up to now, Solana’s transactions and block production have relied on two validator clients that share much of the same codebase, creating a significant risk - a single bug could bring the entire network down. Firedancer, developed in a different programming language and built with a completely new software architecture, greatly enhances Solana’s resilience to outages and helps decentralize the network in a critical area.

As of now, no exact date has been given for the full mainnet launch.

Key events of the last few weeks

EigenLayer’s $EIGEN becomes tradable. As of now, the native token of the restaking protocol trades at a $5.6 billion valuation. (Source: CoinGecko)

Stylus goes live on the Arbitrum Mainnet. The upgrade allows developers to write smart contracts in popular programming languages like Rust, C, and C++, thereby reducing the execution costs of their applications by 10 to 100 times. (Source: Arbitrum)

British government introduces the 'Property (Digital Assets etc) Bill'. The bill proposes to classify digital assets, including cryptocurrencies, NFTs, and tokenized real-world assets, as personal property. This move aims to offer legal protection to consumers and businesses while reinforcing the UK’s status as a center for innovation. The bill is currently in its initial stage of the legislative process. (Source: UK Parliament)

Ethereum Name Service (ENS) announces integration with PayPal and Venmo. Starting now, users in the U.S. can provide a .eth domain when sending cryptocurrencies through PayPal’s two payment platforms. (Source: ENS)

Bhutan’s Bitcoin holdings have been revealed. According to analytics firm Arkham, the Buddhist kingdom at the eastern edge of the Himalayas currently possesses approximately $780 million worth of BTC—nearly three times the amount held by El Salvador. Bhutan acquired these holdings through Bitcoin mining. (Source: Arkham)

Former Alameda CEO Caroline Ellison has been sentenced to two years in prison. While the charges against her were similar to those brought against FTX founder Sam Bankman-Fried, who faces 25 years, Ellison’s sentence was considerably reduced due to her cooperation with authorities. (Source: CNN)

Harris expresses support for digital assets and AI. Speaking at a fundraiser in New York City, Kamala Harris advocated for the advancement of innovative technologies. This marked the first time the U.S. presidential candidate has publicly addressed the crypto industry. (Source: Bloomberg)

What we’ve been reading

Chainalysis: Crypto Global Adoption Index 2024

In their latest report, the analytics firm analyzes both on- and off-chain data to identify countries leading in grassroots crypto adoption. The report sheds light on cryptocurrency use cases across the globe and explores the factors driving crypto adoption in different regions. See Dominic’s LinkedIn Post for his top five takeaways.

BlackRock has published a new report on Bitcoin, where the asset manager examines Bitcoin’s historical performance and its correlation with traditional assets like the S&P 500 and gold. There, BlackRock challenges the common perception that Bitcoin is a typical ‘risk-on’ asset.

Disclaimer

To avoid any misinterpretation, nothing in this blog should be considered as an offer to sell or a solicitation of interest to purchase any securities advised by Blockwall, its affiliates or its representatives. Under no circumstances should anything herein be interpreted as fund marketing materials for prospective investors considering an investment in any Blockwall fund. None of the data and information constitutes general or personalized investment advice and only represents the personal opinion of the author. The author and/or Blockwall may directly or indirectly be exposed to the mentioned assets/investments. For further information please view the full Disclaimer by clicking the button below.

This work is licensed under the Creative Commons Attribution – No Derivatives 4.0 International License. CC BY-ND 4.0 Legal Code | Creative Commons